Financial Aid and Scholarships

General Info

Financial aid programs and services assist students and families with paying for college. At St. Augustine College over 70% of our students receive 100% tuition in the form of Grants and Scholarships.

St. Augustine College requires only one application to apply for financial aid: the Free Application for Federal Student Aid (FAFSA). To apply, please visit FAFSA’s website and use St. Augustine College’s Federal School Code 015415. Prior to completing the FAFSA the student and one parent (if the student is considered dependent) will need to apply for their own FSA ID which is used to electronically sign legally binding documents.

If you are not applying for financial aid of any kind, you do not need to complete and return the FAFSA Waiver Form.

The Financial Aid Office is committed to ensuring that all students looking to receive an exceptional education here at St. Augustine College are able to fulfill their mission. We are available to assist students and parents through the entire financial aid process. Please contact us at financialaid@staugustine.lewisu.edu or by phone at 773-878-8756.

Types of Aid

Federal Financial Aid

Federal financial Aid is government funds—grants, work-study programs, and loans.

How to Apply for Federal Financial Aid

1. Get an FSA ID.

Create an FSA ID to access the Federal Student Aid online system.

2. Fill out the FAFSA®.

The application for federal grants, work-study programs, and loans for college students. St. Augustine school code is 015415

3. Complete Online Loan Counseling

Learn your responsibilities for any federal student loans you receive.

4. Sign Master Promissory Note

A pledge to repay your federal student loans with interest and fees.

5. Receive Your Award Letter

Upon completion of the FAFSA® process, you’ll receive a financial aid award letter in two to four weeks. We recommend applying for financial aid at least one month prior to starting class.

Need Help?

Speak with a St. Augustine College Admissions Counselor or directly to the Financial Aid Office: 773-878-8756

Veteran’s Benefits

Veterans who wish to receive benefits under the Veterans Administration Education Program must complete a Veteran Application for Program of Education form, which is available from any VA office or through the VA website. The St. Augustine College liaison for Veterans Affairs benefits is located in the Office of Financial Aid.

Beginning August 1, 2019, and despite any policy to the contrary, the educational institution named at the bottom of this form will not take any of the four following actions toward any student using U.S. Department of Veterans Affairs (VA) Post 9/11 G.I. Bill (CH.33) or Vocational Rehabilitation and Employment (Ch. 31) benefits, while their payment from the United States Department of Veterans Affairs is pending to the educational institution:

Prevent their enrollment;

Asses a late penalty fee;

Require they secure alternative or additional funding;

Deny their access to any resources (access to classes, libraries, or other institutional facilities) available to other students who have satisfied their tuition and fee bills to the institution.

However, to qualify for this provision, such students may be required to:

Produce the VA’s Certificate of Eligibility by the first day of class;

Provide written request to be certifies;

Provide additional information needed to properly certify the enrollment as described in to other institutional policies (see our VA’s School Certifying Official for all requirements).

GI Bill® is a registered trademark of the U.S. Department of Veterans Affairs (VA). More information about education benefits offered by VA is available at the official U.S. government Web site at https://www.benefits.va.gov/gibill.

Grants

Pell Grant Program

- Description: This program provides direct student grants based on the number of credits enrolled. To determine if you are eligible, the U.S. Department of Education uses a standard formula, passed by Congress, to evaluate the information you report on your FAFSA.

- Eligibility: Student who is enrolled as a regular student in at least three (3) credit hours and who is a United States citizen, national, or permanent resident, refugee or under official political asylum. Students must show satisfactory progress.

Supplemental Educational Opportunity Grants (SEOG)

What is an SEOG?

A Supplemental Educational Opportunity Grant (SEOG) is an award to help you pay for your education after high school. It is for undergraduates only, and it does not have to be paid back.

You can get up to $4,000 a year, depending on your need, the availability of SEOG funds, and the amount of other aid you are receiving.

Federal Direct Student Loans

This federal low-interest loan program is offered by the U.S. Department of Education to eligible students to help cover the cost of higher education at participating Colleges, Universities or Trade Schools. Students may be eligible to receive subsidized and unsubsidized loans based on their financial needs.

Monetary Award Program

This program under the Illinois Student Assistance Commission (ISAC) provides non-repayable Assistance to financially needy students. The Monetary Award Program is for Illinois residents demonstrating financial need and planning to pursue undergraduate study at an approved public or non-public post-secondary institution located in Illinois. Students at varying levels of academic ability can participate in the program provided they can successfully enter and continue to progress satisfactorily through a collegiate level of study. Awards are renewable annually upon proper application.

Eligibility: To qualify for the Monetary Award Program aid, the following criteria must be met:

- Be a citizen or permanent resident of the United States, parole-refugee or a temporary resident;

- Be a resident of the State of Illinois;

- Be eligible to enroll in at least three (3) credit hours per term or full-time (at least 12 hours per term) as an undergraduate student and be in good academic standing in an ISAC approved college, university, hospital school of nursing, or Allied Health program;

- Demonstrate financial need.

Institutional Aid

St. Augustine College offers other forms of institutional aid: the SAC award and the Presidential Discretionary Fund.

Eligibility criteria for all applicants:

- High School graduate or GED recipient.

- Ineligibility for need-based financial aid.

- Have not completed a bachelor’s degree or its equivalent in any country.

- Be a degree seeking student.

Presidential Discretionary Fund

This fund is a limited resources fund disbursed at the discretion of the president. The fund is reserved for special circumstances where students in financial aid may need additional help in covering cost of tuition, fees or textbooks. Students must apply in writing through their Learning Facilitator.

Work-Study Program

What is College Work-Study?

The College Work-Study (CWS) Program provides jobs for undergraduate and graduate students who need financial aid. CWS gives you a chance to earn money to help pay your educational expenses.

How much can I make?

Your pay will be at least the current federal minimum wage, but it may also be related to the type of work you do and its difficulty. Your total CWS award depends on your need, the amount of money your school has for this program, and the amount of aid you get from other programs.

Cares Act

The Coronavirus Aid, Relief, and Economic Security (CARES) Act established the Higher Education Emergency Relief Fund (HEERF) to (i) provide grants to eligible students for expenses related to the disruption of campus operations due to COVID-19 (“COVID-related expenses”); and (ii) cover institutional costs associated with significant changes to the delivery of instruction due to the coronavirus.

According to the Department of Education, students who have completed an FAFSA®, are Title IV aid eligible and were enrolled in what were intended to be face-to-face classes when St. Augustine closed its campus are eligible to apply.

For students who are eligible to apply for the FAFSA but have not completed it, they need to do so before they can be considered for CARES Act grants. These students are highly encouraged to complete the FAFSA before June 15. An application for CARES Act grants will be emailed to these students after their FAFSA applications have been verified.

Loans

Students who complete an FAFSA ®and are enrolled at least half-time in a degree program may be eligible for a need-based subsidized student Loan. If you qualify for a subsidized student loan, the government will pay the interest on your loan while you are in school.

If you do not qualify for a subsidized student loan, but still complete your FAFSA® and are enrolled at least half-time, you may borrow an unsubsidized student loan. Interest on this loan will accrue throughout the life of your loan, but you are not required to make interest payments while you are in school.

The Federal Government set loan limits for undergraduate students based on how many college credit hours you have completed.

Direct Subsidized and Unsubsidized Loans that are disbursed on or after July 1, 2024, and before July 1, 2025, will have an interest rate of 6.53%.

The origination fee (Loan Fee) will be 1.057% for Direct Subsidized and Unsubsidized Loans with a first disbursement date on or after October 1, 2020, and before October 1, 2025.

You do not have to make payments on your Direct Student Loan while you are in school. Repayment begins six months after you cease to be enrolled at least half-time, stop attending or graduate.

If you have never borrowed a Federal Direct Student Loan before, then you must complete a Direct Loan Master Promissory Note (MPN). You also must complete Direct Loan Entrance counseling. Both of these items can be done online using your FSA ID. These documents only need to be completed one time (rather than annually, like the FAFSA). They will be good for all the Direct Loans that you borrow while attending St. Augustine College.

The Master Promissory Note (MPN) and the Entrance Counseling, must be received by the Financial Aid Office before your loan can be processed.

Learn more about the Direct Student Loan, limits, interest, origination fees and repayments at: https://studentaid.gov/understand-aid/types/loans/subsidized-unsubsidized

Forms, Guides & Resources

2024-25 FORMS

All completed forms can be emailed to financialaid@staugustine.lewisu.edu.

If a required form is not listed please contact our Financial Aid Office for assistance.

If you are required to submit a IL State Residency Evaluation, please contact our Financial Aid Office for more details.

When printing the forms below please set the printer’s page sizing option to “FIT”

Dependent Verification Worksheet

Independent Verification Worksheet

Statement of Educational Purpose

Verification of Non Tax Filing – Parent

Academic Policy

- Financial aid will be offered only after determination that resources of the family or individual student are insufficient to meet the student’s educational expenses.

- Student aid funds are used for students who are carrying a full-time program of study (normally 12 credit hours or more), students who are carrying a three-quarter part-time program (from 9-11 credit hours), or students who are carrying a half-time program (normally 6-8 credit hours), or a less than half-time program (normally 3-4 credit hours).

- Students must have legal status in the United States under any of the following categories:

A U.S citizen or national;

U.S. Permanent Resident;

Other eligible noncitizens. - Students must maintain satisfactory progress as defined in the satisfactory academic progress policy.

- The College will evaluate financial aid applicants on the basis of financial need.

- The College will combine its financial aid resources to maximize its ability to meet students’ needs.

- No aid program shall attempt to restrict the College in what it teaches or restrict its academic freedom.

- The College will promote the financial aid program and invite donors to join in the support of this program.

- All donations to the financial aid program must be approved by the Governing Board.

- Funds received from donors will be subject to policies, rules, and regulations governing financial aid at St. Augustine College.

- The College encourages donations to assist any able and needy student; however, stipulations may be made by donors concerning high school, residency, field of study and year in college.

- The College will publish each year, in an appropriate manner, the names of all donors of financial aid unless otherwise directed.

- Donations will be deposited in the General Scholarship Fund and disbursed from that Fund. The College will inform the donor and the student of the award.

- Donors must contact the Development Office in writing concerning their intent to donate funds.

- All funds must be received in advance.

- The Governing Board of St. Augustine College designates certain funds to be used as college grants to needy students.

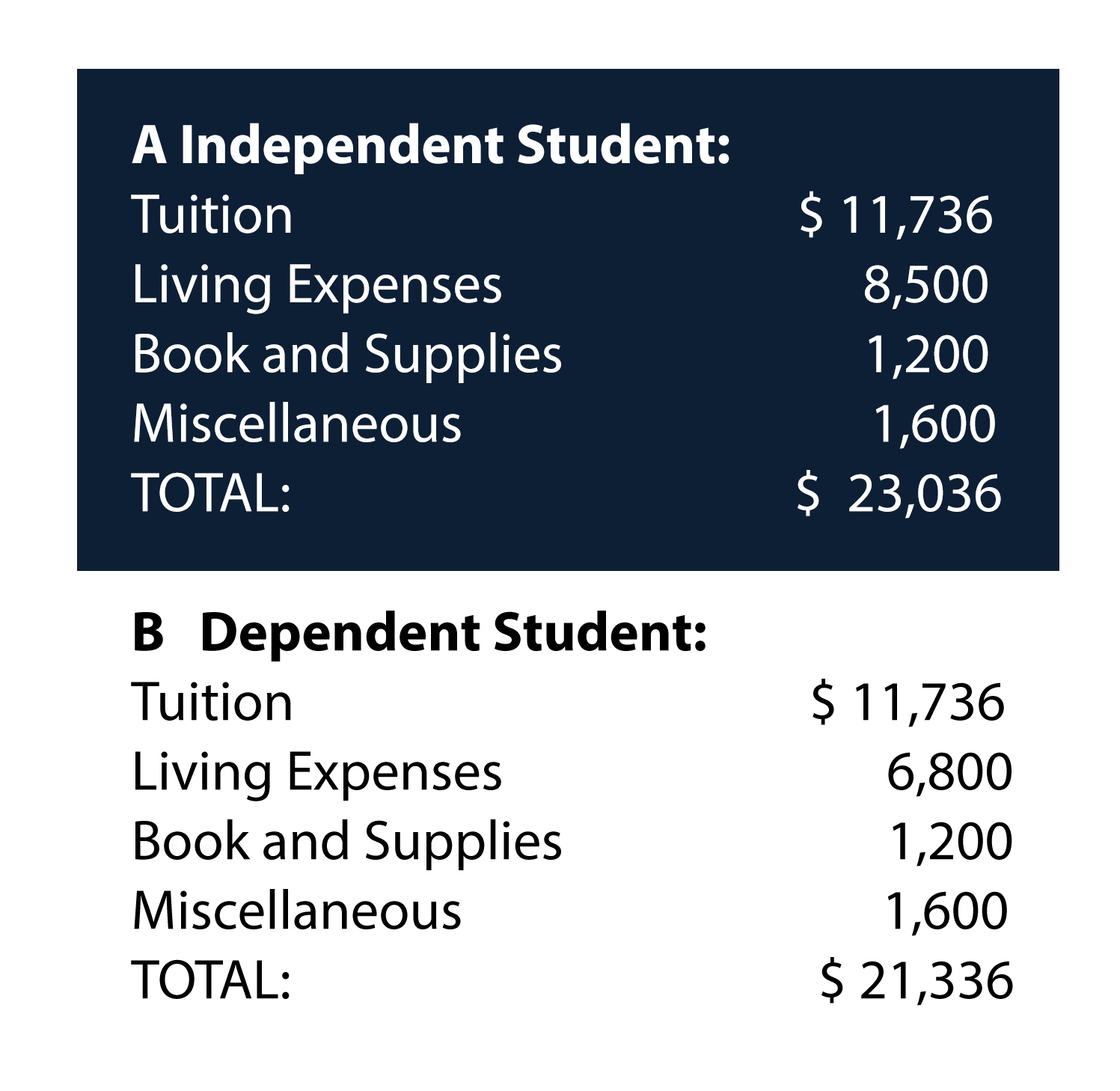

- The Student Expenses Budget at St. Augustine College is broken down as follows:

However, the amount allocated to each student will be based on the Pell Grant cost allowances which are:

A. Actual charge for tuition and fees based on credits recorded in the Registrar’s Office

at the end of the refund period.

B. A standard allowance for maintenance is to be determined annually by the U.S. Department of Education.

C. A standard allowance for books, supplies, and miscellaneous expenses will be determined annually by the U. S. Department of Education.

ISIR Office Procedures

The Federal Electronic Institutional Student Information Record (ISIR) is the need analysis document used by St. Augustine College. The College will process a student’s financial aid only when a valid ISIR is posted on our PowerFaids module with the latest transaction available via the ED Connect and ED Express software.

The procedures follow a consistent pattern:

1. The ISIR is received, validated and processed according to the student’s enrollment status.

2. Inactive folders are reviewed to see if the applicant has a student file; if not, a new folder is set up.

3. Financial Aid Office personnel check the academic satisfactory progress list of enrollees from the previous academic school year.

4. The completed folder (valid ISIR and master file) is reviewed by Financial Aid Office personnel and an award is made based on student enrollment status. The person making the award signs and dates the award.

5. An award letter notification is mailed to those eligible for aid.

6. Financial Aid Office personnel calculate the proper award based on the Pell Grant schedule and the cost of attendance. Students who are full-time (12 credits or more per semester) will receive a full-time award; students who are three-quarter time (9-11 credits per semester) will receive three-quarter awarding; students who are half-time (6-8 credits per semester) will receive half-time awarding, and students who are less-than half-time (3-5 credits per semester) will receive less than half-time awarding of a full-time award.

Financial Aid Verification Guide

FINANCIAL AID VERIFICATION GUIDE

By law, the Financial Aid Office is required to provide students with information regarding the verification process. This document is for informational purposes and is intended to be used as a resource to guide you through the verification process.

What is verification?

Verification is the process institutions use to review student financial aid files for accuracy. Students are selected for this process by the federal government or by the institution they are planning to attend.

Who is selected for verification?

Last year approximately 30 percent of all financial aid applicants were selected by the federal government for verification. Students are normally selected at random; however, they may be selected if their FAFSA® appears to have inconsistent information, numerous corrections have been submitted to FAFSA® data, or, if estimated tax information was used to complete the FAFSA®.

What items are required by law to be verified?

All applicants selected for verification must confirm some or all of the following information:

Family size (as defined on the FAFSA®) of the student, parent(s) and siblings or student and spouse (if married);

Number of family members enrolled at least half-time and pursuing a degree/certificate in college;

Food stamps – Supplemental Nutrition Assistance Program (SNAP) – if receipt is reported on FAFSA®; Child support paid – if reported on the FAFSA®;

Income earned from work – provide W-2 form(s).

Tax filers selected for verification may be required to confirm the following information via the FAFSA IRS Data Retrieval Process or by providing an IRS-generated tax return transcript:

Adjusted Gross Income

U.S. Income Tax Paid

Untaxed IRA Distributions

Untaxed Pension Distributions

IRA Deductions/Payments

Tax Exempt Interest

Education Credits

In addition, applicants may be required to provide:

Documentation of a high school diploma, recognized equivalent or home school credentials

A copy of valid (e.g., unexpired) government-issued photo identification, such as a driver’s license, passport, or military ID.

A signed statement of education purpose for the requested Financial Aid award year

Documentation of other untaxed income not reported on your federal tax form

Clarification of parents’ marital status

What happens once I submit all verification documents?

After all requested information is submitted to the Financial Aid Office, the student’s file will be reviewed. If we have further questions, the student will be contacted for additional clarification. It is the student’s responsibility to respond to these requests for information. Failing to do so will result in an incomplete file, which will delay the completion of your financial aid award and may lessen your aid opportunities.

If corrections need to be made to your FAFSA, the Financial Aid Office will make them on your behalf. The Central Processing System (FAFSA processor) will notify you of the changes via the email you provided on the FAFSA or U.S. mail if no email address was indicated.

If my file is being verified, when will I receive my official award letter?

The Financial Aid Office will create “tentative” award letters for incoming students who have supplied a valid FAFSA even though additional information is required. The award will remain tentative until all required information/documents are received, reviewed and all conflicting data is resolved. An official award letter will be generated and sent via U.S. mail within two weeks of the verification is completed. If any subsequent award changes need to be done. A revised award letter notification will be sent to you via US mail.

Verification Tips

Be sure to:

Submit verification documents as early as possible but no later than May, to receive full financial aid consideration, for the next academic year.

Provide all necessary signatures on verification worksheet (both student and parent if dependent).

Keep copies of all documents you submit.

Include the student’s name and St. Augustine College ID number on every form submitted to our office. Request your income tax data be imported via the IRS Data Retrieval Process at fafsa.gov; thus, eliminating the need for a tax return transcript.

Can I eliminate the need to submit an IRS generated tax return transcript?

Students and parents or students and spouses who import their income tax return information using the IRS Data Retrieval Process – either when initially completing the FAFSA or through the correction process – will be considered to have verified the FAFSA IRS information for Adjusted Gross Income (AGI), taxes paid, and untaxed income reported on the tax form. This is the fastest, easiest and most secure method to provide your tax data. However, if changes were made to the imported information or if the institution has reason to believe that the information transferred is inaccurate, the applicant must submit an IRS generated tax return transcript.

How do I print a tax return transcript?

You may print a tax return transcript at irs.gov/Individuals/Get-Transcript within 45 days of electronically filing your federal tax return. Or you may order a tax return transcript by calling the IRS at (800) 829-1040. This is a summary of your tax return and is required if you cannot perform the IRS Data Retrieval process. Federal guidelines no longer permit us to receive a signed copy of your federal tax documents.

Why is a signed copy of my federal tax document no longer sufficient for verification?

Congress now mandates tax return transcripts as the only document that an applicant, parents and/or spouse may provide. This change was enacted to ensure federal funds are distributed to eligible applicants, decrease errors on the FAFSA and reduce fraud.

What if I haven’t filed a tax return yet?

If your tax return has not been filed yet but you have been granted a filing extension by the IRS, you must submit:

- A copy of the IRS Form 4868 (extension notice) or a copy of the IRS’s approval of an extension beyond the automatic six-month extension; and,

- A Copy of W-2 forms from each source of employment; and,

- A signed statement certifying the amount of the AGI and U.S. income tax paid.

Once you have electronically filed your federal taxes, wait three weeks, and then return to fafsa.gov to have your tax information automatically transferred to the FAFSA by the IRS Data Retrieval Process if required by the Financial Aid Office.

I can’t locate all my W-2 forms; what can I do?

Federal law requires the submission of all W-2 forms from all employment sources for non-tax filers. The office of Financial aid may request them for tax filers as well. If the employer is still in business, you must contact them and request a duplicate copy of your W-2 form. If you can’t obtain a W-2 form due to extenuating circumstances (i.e., natural disaster, business ceases to exist/dissolved, etc.), you must provide a SIGNED statement that includes:

- Amount of income earned from work;

- The source of that income (employer’s name);

- The employer’s phone number;

- The reason that the W-2 form is not available.

Based on this information provided, the institution may accept the signed statement as proof or require you to obtain the actual W-2 form.

What if my parents are divorced but filed a joint tax return?

If the legal parents, regardless of gender, are divorced/separated and are still living together both parents income must be provided; thus, submit the IRS tax return transcript for each parent. You will also need to submit W-2 forms for both parents.

If the legal parents, regardless of gender, are divorced/separated and are NOT living together, but filed a joint tax return, you will need to submit the IRS generated joint tax return transcript to the Financial Aid Office. You will also need to submit the W-2 forms for the parent who the student lived with most during the past 12 months. Only this parent’s income will be considered.

What tax information do I submit if my parent is remarried?

If the parent you live with is remarried and a joint tax return was filed, you may simply transfer the tax data to the FAFSA via the IRS Data Retrieval Process if you have not already done so at fafsa.gov. If separate tax forms were filed, federal guidelines require the Financial Aid Office to receive the IRS generated tax return transcript from each individual (parent and stepparent) even if the stepparent doesn’t help pay for the student’s education.

What tax information do I submit if my parent is widowed?

If your parent is widowed and filed a joint tax return with the deceased parent, you need to submit the IRS generated tax return transcript to the Financial Aid Office along with the surviving parent’s W-2 forms. If a source of income or loss reported on the current year tax form will not be reoccurring as a result of your parent’s death, please indicate so in a SIGNED statement. Only the income of the surviving parent will be considered.

Referral of Fraud Cases

According to federal regulations, if the Financial Aid Office suspects that a student or parent has misreported information or altered documentation to fraudulently obtain federal funds, we are obligated to report that suspicion and provide evidence to the U.S. Office of Inspector General. If you purposely give false or misleading information, you may be fined up to $20,000, sent to prison, or both.

Verification Procedures

All Pell Grant eligibility reports selected for verification by ED Express must have financial data verified. All ISIR’s verifications must be completed before the ISIR is considered valid.

The procedures for ISIR validation follow a consistent pattern:

- After all documents have been supplied or pulled from the student’s file, the student is sent to see the Financial Aid Counselor.

- Validation is done by the Financial Aid Counselor, face-to-face with the student, during which the following data elements will be verified:

V1- Standard Verification Group

- Household size;

- Number enrolled in college;

- Adjusted Gross Income (AGI);

- U.S. income tax paid; and,

- Other untaxed income and benefits;

- SNAP if reported on ISIR; and

- Child support Paid reported on ISIR.

V3- Child support Paid reported Group

V4- Custom Verification Group (High School Completion Status/Statement of Educational purpose; SNAP, if reported on ISIR; Child Support Paid, if reported on the ISIR)

V5- Aggregate Verification Group (Standard Verification Criteria (V1); High School completion Status; Identity/Statement of Educational purpose).

V6- Household Resources Verification Group (Standard Varication Criteria (V1); Other Untaxed Income; SNAP, if reported on ISIR; Child Support Paid, if reported on ISIR)

3. Supporting documentation collected from the student (and parents or spouse, if applicable) is compared to the information reported on the student’s Institutional Student Information Record (ISIR). Verification documentation collected must be retained in the student’s file as evidence that the process was completed.

4. The validator verifies the information on the ISIR by asking the student if the information is correct. All boxes must be verified.

5. If all of the information in STEP THREE is answered “NO,” then STEP FOUR must be verified with the parents’ (or guardians) and the student’s income tax forms.

6. If one question in STEP THREE is answered “YES,” the student’s income tax forms must be used to verify STEP TWO.

7. The Financial Aid Counselor must request a report from the Social Security Administration stating the yearly support paid on behalf of any student who receives such aid.

When the report is received and posted in the POWERFAIDS MODULE in hand, the validation is the same as above for STEP THREE and FOUR. Completion of the validation process will be performed by the corresponding Financial Aid Counselor.

In the event that a correction must be made, it will be re-transmitted through the EDE Express System.

Return of Title IV Funds

This policy applies to students who received federal Title IV student aid (Federal Pell Grant and Federal Supplemental Educational Opportunity Grant) and completely terminate enrollment prior to completing 60% of the enrollment period.

The amount of Title IV aid an institution must refund to the federal programs is determined by the federal return to Title IV funds formula as specified in Section 484 B of the Higher Education Act. St. Augustine College utilizes software provided by the Department of Education to calculate the amount of aid that must be refunded.

A St. Augustine College student who officially withdraws at any time during the semester must go through a process which begins with a Learning Facilitator. The student is then advised by the Office of Financial Aid, so s/he is aware of the effect of this decision on his/her aid package. Appropriate calculations will be performed prior to the official withdrawal so the student is aware of the precise fiscal consequences. If the student decides to withdraw, the official withdrawal date provided by the Registrar’s Office based on the last date of attendance, as submitted by the instructor, is utilized to document the last date of enrollment for an official withdrawal in the Return to Title IV calculation.

A student who earns all failing grades based on non-attendance is considered an unofficial withdrawal for the purpose of the Return to Title IV policy. The last date of attendance documented on the Registrar’s Office attendance report, as submitted by the instructor, will be utilized for the return of Title IV funds calculation. If the date cannot be determined, the mid-point of the semester will be utilized.

St. Augustine College returns unearned aid used to pay institutional charges within 45 days of the withdrawal determination in the following order:

- Federal Pell Grant

- Federal Supplemental Educational Opportunity Grant

- Federal Direct Student Loan

If it is determined the student is eligible for Title IV funds post withdrawal, these funds will be automatically credited to the student account for allowable current outstanding charges within 45 days of the date the school determined the student withdrew. Students without outstanding charges will have grant funding refunded within 45 days of the date the school determined the student withdrew. If a student withdraws prior to completing verification, all Title IV funds will be returned.

Copies of information from the Student Aid Handbook or other regulatory sources can also be made available at the request of the student.

Higher Education Emergency Relief Fund (HEERF)

The Coronavirus Aid, Relief, and Economic Security (CARES) Act established the Higher Education Emergency Relief Fund (HEERF) to: (i) provide grants to eligible students for expenses related to the disruption of campus operations due to COVID-19 (“COVID-related expenses”); and (ii) cover institutional costs associated with significant changes to the delivery of instruction due to the coronavirus.

According to the Department of Education, students who have completed an FAFSA®, are Title IV aid eligible, and were enrolled in what were intended to be face-to-face classes when St. Augustine closed its campus are eligible to apply.

For students who are eligible to apply for the FAFSA® but have not completed it, they need to do so before they can be considered for CARES Act grants. These students are highly encouraged to complete the FAFSA® before June 15. An application for CARES Act grants will be emailed to these students after their FAFSA® applications have been verified.

CARES Act Reports

Instructions or Directions Given to the Students

Grants are awarded on a first-come-first-served basis to eligible students beginning with the Spring 2020 semester—and then in each semester thereafter—until the funds are exhausted. Only one grant is available per student.

Quarterly-Budget-and-Expenditure-Reporting-CARES-Act-2020-Q3

Quarterly-Budget-and-Expenditure-Reporting-CARES-Act-2020-Q4

Quarterly-Budget-and-Expenditure-Reporting-CARES-Act-2021-Q1

Quarterly-Budget-and-Expenditure-Reporting-CARES-Act-2021-Q2

Quarterly-Budget-and-Expenditure-Reporting-CARES-Act-2021-Q3

Quarterly-Budget-and-Expenditure-Reporting-CARES-Act-2021-Q4

HEERF Student Aid Portion Quarterly Report 2020 Q2

HEERF Student Aid Portion Quarterly Report 2020 Q3

HEERF Student Aid Portion Quarterly Report 2020 Q4

HEERF Student Aid Portion Quarterly Report 2021 Q1

HEERF Student Aid Portion Quarterly Report 2021 Q2

HEERF Student Aid Portion Quarterly Report 2021 Q3

HEERF Student Aid Portion Quarterly Report 2021 Q4

HEERF Student Aid Portion Quarterly Report 2022 Q1

HEERF Student Aid Portion Quarterly Report 2022 Q2

HEERF Student Aid Portion Quarterly Report 2022 Q3

HEERF Student Aid Portion Quarterly Report 2022 Q4

HEERF Student Aid Portion Quarterly Report 2023 Q1

HEERF Student Aid Portion Quarterly Report 2023 Q2

CARES Act FAQs

What makes a student eligible for the CARES Act funds?

Students will need to make sure they have filed their Free Application for Federal Student Aid (FAFSA) as soon as possible. Please note that assistance is subject to availability of funds, and applicants must meet eligibility criteria.

Am I eligible for CARES Act funds?

Undergraduate students are eligible, but must have submitted a 2019-2020 FAFSA or must submit a FAFSA application by the June 30 deadline in order to be eligible for the funding. Students must also meet federal aid eligibility criteria, including but not limited to:

- Being a U.S. citizen or eligible non-citizen (i.e., permanent resident or conditional permanent resident)

- Having a valid Social Security number

- Having a high school diploma, GED or completion of high school in an approved homeschool setting

- Being degree-seeking

- Must be enrolled in the term for which they are seeking assistance

- Cannot be in default on federal student loans

- Being registered with Selective Service, if male

- Meeting Satisfactory Academic Progress

- Cannot exceed aggregate loan limit or Pell Grant lifetime usage

- Cannot owe an overpayment on federal aid programs

Funding is limited, and applications will be reviewed based upon request. For students who are not eligible for CARES Act funding.

What if I haven’t submitted a FAFSA for 2019-2020?

Students may still be eligible for CARES Act funding but must submit an FAFSA® application. We recommend these students apply for CARES Act funding and fill out an FAFSA® application, which takes the Department of Education 48-72 hours to process.

What are the types of expenses covered by CARES Act funding?

CARES Act funds are designed to assist with expenses related to the disruption of campus operations due to COVID-19, such as housing, food, course materials,

technology, healthcare and child care.

How did SAC develop eligibility criteria?

The college followed guidance from the U.S. Department of Education.

How long before I know if I’m awarded CARES Act funds?

Due to the anticipated high volume of applications, we expect that it will be 3-4 weeks before students will receive the money.

Why was I was not funded the amount that I requested from CARES Act?

Every application will be evaluated individually, and the amount granted will be based on the request and available funding.

I graduated in Spring 2020. Can I still receive emergency grant funding?

Yes, students who graduated in Spring 2020 were eligible to apply for funding. The application window closed at 11:59 p.m. on Tuesday, May 19 2021.

I am an undocumented, international or online student. What resources are available to help me?

The federal legislation outlined eligibility criteria, not SAC. The federal funding is designed to assist students who meet eligibility criteria and who had their face-to-face instruction impacted by COVID-19.

Is this funding a loan that will need to be repaid?

No, the CARES Act money is a federal emergency grant that is not required to be repaid.

If I depend on financial support from my parents and they were negatively impacted by COVID-19, am I eligible for this funding?

If families incurred expenses due to reduced work hours or loss of employment due to COVID-19 and those circumstances impacted students’ ability to pay for costs related to their pursuit of higher education, they can receive funds if the student files an FAFSA® and demonstrates eligibility for the Pell Grant and/or the MAP award.

Who can I contact if I have additional questions?

If your question is not answered here, email: mzambonino@staugustine.edu, and your questions will be responded to within 48 business hours in the order in which they were received.

Satisfactory Academic Progress Policy

St. Augustine College’s Policy for Satisfactory Standards and Progress is aimed at promoting the pursuit of high academic achievement. The College’s educational philosophy abides by the principle that “a student’s performance will rise to match his/her educator’s expectations.”

The College policy does not imply that individual learning differences be ignored or forced into a system of arbitrary inflexibility. The Institution is devoted to the fostering of educational achievement within a framework of realistic parameters and availability of resources. The parameters, which define policy standards, represent the minimal compliance requirements for academic and financial aid standing. Students must comply with the policy in order to maintain eligibility for participating in the financial aid programs. The “Satisfactory Academic Standards and Progress Policy” is based on students’ compliance with the policy’s standards. Students’ academic standing and progress will be reviewed at the end of the Fall and Spring semesters. Students who have questions about academic status and/or satisfactory progress must consult with their Learning Facilitator.

The Registrar’s Office, on the basis of reports received from the Student Affairs Office, issues mid-term reports, which are used by Learning Facilitators to monitor student performance.

The College’s Satisfactory Academic Standards and Progress Policy includes two parts:

Part I: Academic Standards; and

Part II: Satisfactory Academic Progress for Financial Aid Eligibility.

Part I: Academic Standards

Students must maintain, or exceed, minimum standards for good academic standing in order to avoid Academic Warning or Academic Exclusion from the College. A student is considered to be in compliance with the Satisfactory Academic Standards Policy if his/her academic status is either in Good Standing or Academic Warning at the end of any semester. Whatever the situation regarding compliance with the policy, a minimum GPA of 2.0 must always be

met for graduation.

Cumulative GPA Measurement

The cumulative grade point average (GPA) is computed at the end of each semester on the basis of all grades, A through F, earned in College credit courses.

Grade Point Designations

Used in GPA computation: Not used in GPA computation:

A = 4 points, counted as registered hours I = Counted as registered hours

B = 3 points, counted as registered hours V = Not counted as registered hours

C = 2 points, counted as registered hours EW = Not counted as registered hours

D = 1 points, counted as registered hours AW = Counted as registered hours

F = 0 points, counted as registered hours SW = Counted as registered hours

IF = 0 points, counted as registered hours S = Counted as registered hours

U = Counted as registered hours

NG = Counted as registered hours

T = Counted as registered hours

TU = Not counted as registered hours

The symbols “*” and “R” do not affect the registered hours’ value for the course.

Minimum Cumulative Grade Point Average

To remain in good academic standing, a student must maintain a minimum cumulative grade point average in accordance with the schedule of the Table of Minimum Standards for Good Academic Standing. Failure to meet these standards will result in a status designation of either Academic Warning or Academic Exclusion.

Table of Minimum Standards for Good Academic Standing

Cumulative Number Minimum Cumulative

of Registered Hours GPA

0-6 0.5

7-12 1.0

13-24 1.3

25-36 1.6

37-48 1.9

49 – above 2.0

The table indicates minimum requirements. Some programs have different standards. Refer to Additional Admission Requirements for the Bachelor of Social Work and the Respiratory Therapy program.

Academic Warning

Students who do not achieve the minimum required GPA at the end of any given semester will be placed on Academic Warningfor the following semester. Students will be informed of Academic Warning status on the final grade report. Students in Academic Warning status are allowed to register for the following semester.

Academic Exclusion

Students on Academic Warning who do not achieve the minimum required cumulative grade point average by the end of the warning period will be placed on Academic Exclusion.

Students who are on Academic Exclusion at the end of the Spring Semester are not allowed to register until the following Spring Semester. Students who are on Academic Exclusion at the end of the Fall Semester are not allowed to register until the following Fall Semester.

Appeal Procedures in Case of Academic Exclusion

To appeal Academic Exclusion status, a student must initiate a written appeal, through a Learning Facilitator. The Vice President for Enrollment Management will take the case to the Appeals Committee for Satisfactory Academic Progress chaired by the Vice President of Academic Affairs. The student must show either:

1. Extenuating Circumstances

Extenuating circumstances are those beyond the immediate control of a student, which prevent a student from maintaining the GPA as required in the Table of Minimum Standards. Such circumstances include, but are not limited to:

- Death in the immediate family,

- Health/life-threatening situation or extended (over two weeks) and documented illness of the student or a member of the student’s immediate family requiring medical intervention or hospitalization,

- Childbirth by the student or student’s spouse,

- Family problems, such as separation/divorce, or other life-changing situations.

2. Administrative Error

There was a miscalculation of any of the factors that affect the GPA. A successful appeal will allow the student to register in the following semester.

Part II: Satisfactory Academic Progress for Financial Aid

Satisfactory Academic Progress for Financial Aid is measured using three criteria.

- Academic Progress.

Academic progress is measured using the “table of minimum standards for good academic standing.” Each term your local GPA is compared to the table and a determination is made. If your local GPA meets or exceeds the table value, you are “IN academic compliance” (IA). If your local GPA is below the minimum standard, you are “NOT IN academic compliance” (NA).

2. Satisfactory Completion Rate.

Academic progress is measured using the “table of minimum standards for good academic standing.” Each term your local GPA is compared to the table and a determination is made. If your local GPA meets or exceeds the table value, you are “IN academic compliance” (IA). If your local GPA is below the minimum standard, you are “NOT IN academic compliance” (NA).

3. Maximum Time Frame.

You must complete your degree within 1½ times the number of hours required for the degree and program of study. If you have not yet attempted 90 hours (192 hours for BSW students) you are “IN time frame” (IT). If you exceed the maximum time frame you will be “NOT IN time frame” (NT). If you exceed the maximum time frame you will need to file an appeal to review your financial aid eligibility, regardless of academic or completion rate.

Satisfactory Academic Progress for Financial Aid will be computed at the end of each term after final grades are submitted. The Financial Aid Statuses are:

Good Progress – If you are in academic progress (IA)

AND in completion (IC) your status will be indicated as (GF). If you are in your first term of attendance, you automatically start at (GF) at the beginning of your first term.

Warning – If you were in (GF) your prior term of enrollment and you end the term out of academic compliance (NA) or out of completion rate (NC), you will be placed on warning (WF). If you started the term on (WF) and end the term on (GF), you will regain (GF) status.

Appeal – If you do not regain (GF) after a term on warning, your status will be changed to “Appeal” and you will need to fill out an appeal form with a Learning Facilitator. You will not be eligible for further financial aid until your appeal is reviewed. Appeals will be reviewed by the Financial Aid Appeal Committee and either approved (AA) or denied (AD). If your appeal is approved (AA) you will be allowed ONE further term to regain good progress (GF). If you do

NOT regain compliance, you must have an academic plan created by a Learning Facilitator and approved by the Financial Aid Appeal Committee and the Vice President of Academic Affairs.

Plan – If your plan is approved (PL), you will be required to perform as agreed by you, the

Financial Aid Appeal Committee and the Dean of Instruction. This plan must be reviewed EACH semester for compliance. If you are NOT in compliance, you will be “ineligible for financial aid” (XF).

Ineligible – This status is maintained and cleared by the Financial Aid Appeal Committee. You will not regain eligibility with another appeal and review.

Appeal Procedures for Maximum Time Frame Hold

Students may file an official appeal requesting an extension of their Maximum Time Frame. An extension may be approved for students who had to enroll in remedial/developmental courses; in this case, the maximum time frame may be extended up to 30 hours.

Students who successfully appeal their Hold status will regain financial aid eligibility. Students who are unsuccessful may attend the College at their own expense, provided they meet the College’s academic standards.

Transfer Students: Maximum Time Frame

Students transferring from other colleges to St. Augustine College will have their accepted registered hours applied toward their Maximum Time Frame. Accepted hours must be completed in college-level courses in which the student received a grade of “C” or better.

The Following Conditions Must Be Met to Maintain Eligibility for Financial Aid:

- Changes in the recipient’s marital, credit hour or residence status must be reported to the Financial Aid Office for review and possible adjustment of awards.

- Unexpected changes in the family’s financial condition should be reported to the Financial Aid Office for review and possible adjustment of awards.

- Outside aid received by applicant who is not listed on the award letter must be reported.

- If the recipient is in default on a federal loan received for attendance at other institutions or owes a refund for federal financial aid received when not earned, the Financial Aid Office must be notified immediately and awards will become void, after acceptance or declination of financial aid offered and returned to the Financial Aid Office.